STATEMENT OUTLINING

CHALLENGES WITHIN THE INDUSTRY

The challenge is to effectively manage risks by mapping the risks underwritten by the cedant over the past 3 to 5 years, selecting appropriate risk bands tailored to the cedant, analyzing loss patterns, and projecting losses using data modeling techniques.

PROPOSED REMEDY

FOR THE SPECIFIED PROBLEM

Utilize historical data to map risks underwritten by the cedant over the past 3 to 5 years, providing a comprehensive overview of past performance and risk exposure.

Employ sophisticated algorithms to identify and select appropriate risk bands that are specifically tailored to the cedant's unique profile, ensuring optimal risk categorization with minimal manual intervention.

Loss Pattern Analysis:

Leverage data analytics to thoroughly analyze loss patterns, uncovering trends and insights that can aid well inform decision-making.

Implement advanced data modeling techniques to project future losses, enabling proactive risk management and more accurate financial planning.

Provide a customizable, state-of-the-art dashboard that integrates all these features, offering real-time data analysis and visualization using AI and ML tools to enhance decision-making processes.

RISK MAPPING

RISK BAND SELECTION

LOSS PROJECTION

Comprehensive Dashboard

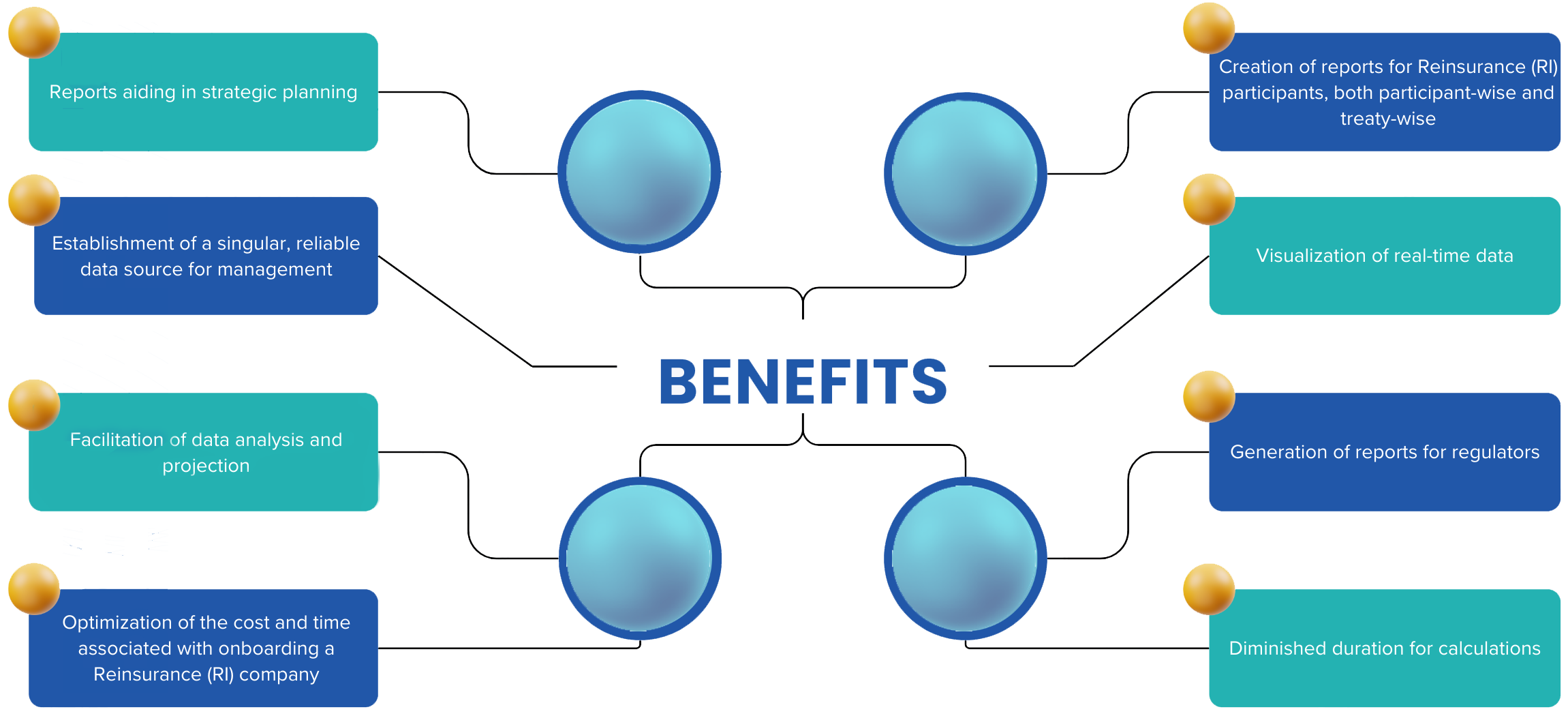

BENEFITS

SPECIFICATIONS

PROJECTIONS

- Calculate and project data based on previous years data

- Flexibility to modify any configuration & settings in real-time

- Supports

- Multiple Companies

- Multiple parameters: Networth, Net Retention & %age of NW, Avg PML Multiple Treaties in the market

- Obligatory Quota Share

- Voluntary Quota Share

- 1ˢᵗ slurplus

- 2ⁿᵈ Slurplus

- 2ⁿᵈ retention

- Commission(flat/sliding), Loss Corridors , limits & attachment points

- Bandwise Analysis

- Non proportional Treaties:

- RiskXL & CatXL with multiple customized layers Risk Type wise analysis

- LOB wise analysis

- Any customized business rules can be implemented

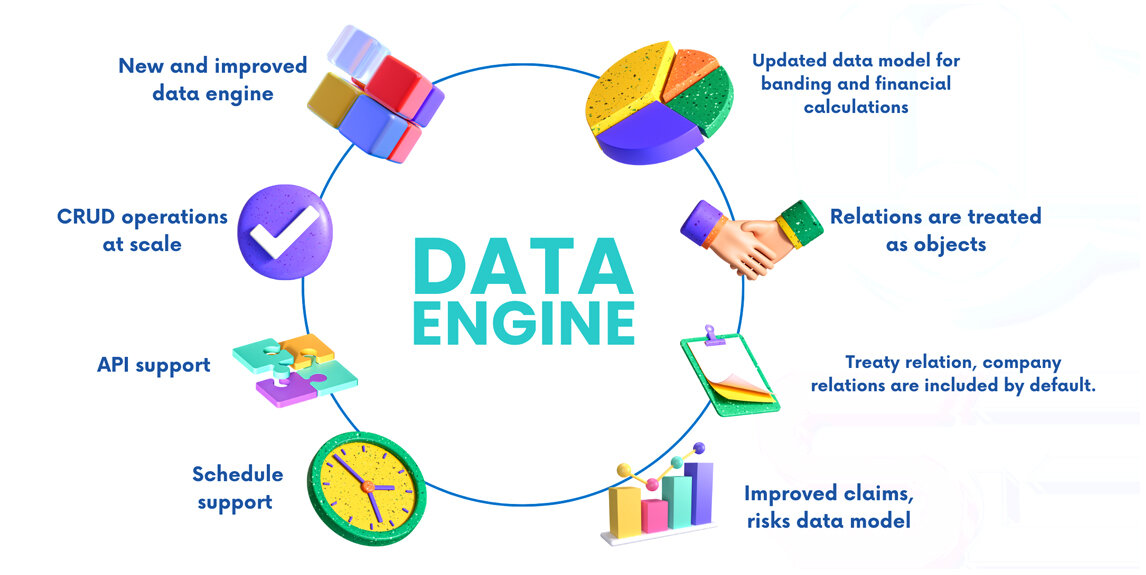

DATA ENGINE

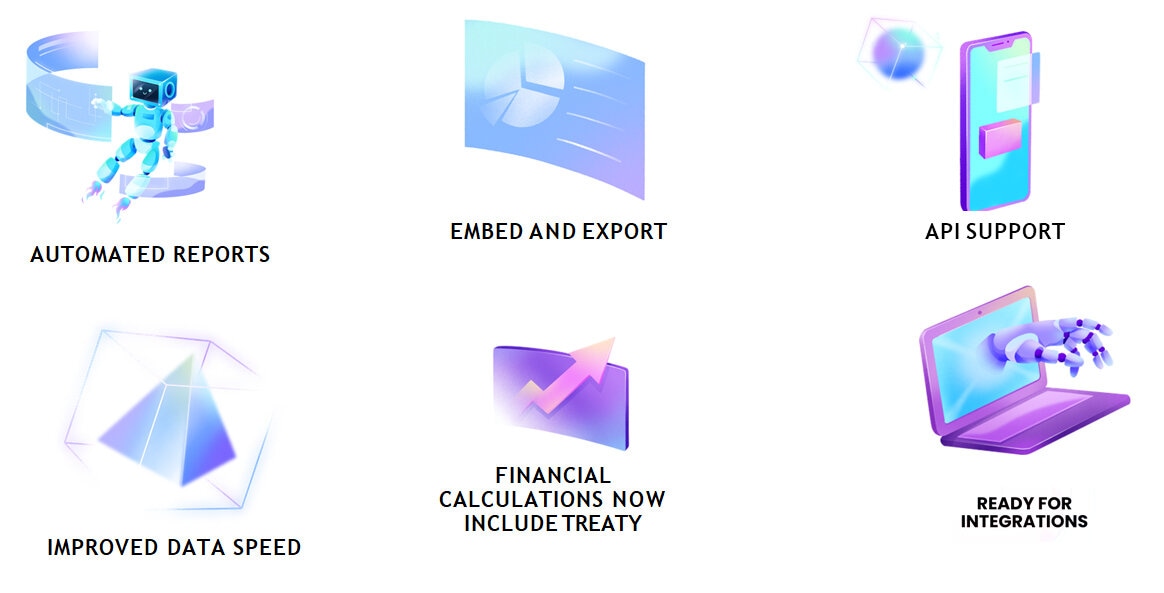

INTELLIGENT REPORTS

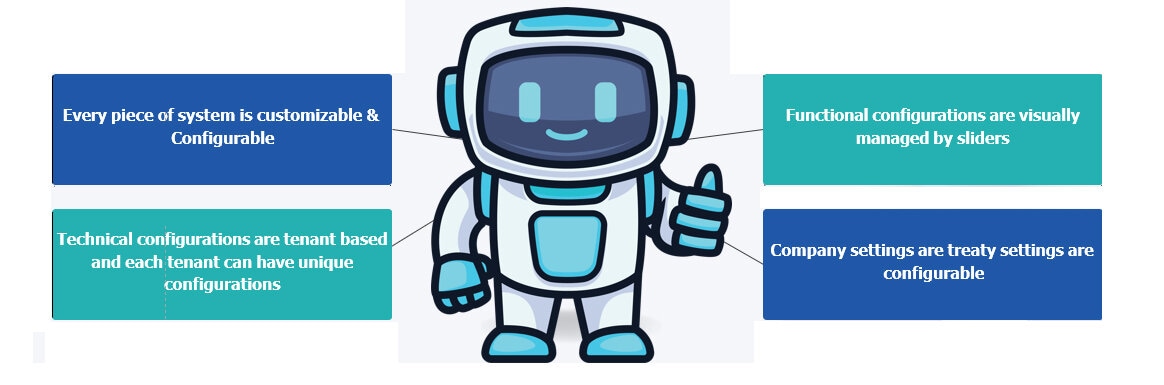

CONFIGURATION MANAGEMENT

CLOUD SUPPORT

INTELLIGENT CHAT

INSURANCE AGENT – AI POWERED

Answer questions on policies, claims etc.

Answer questions on policies, claims etc.

Generate drafts of communications & provide recommendations

Generate drafts of communications & provide recommendations

Connect your database to chat agent and generate insights

Connect your database to chat agent and generate insights

Generate charts based on questions

Generate charts based on questions

Customer Service agent with integrated data support

Customer Service agent with integrated data support

Multitenancy